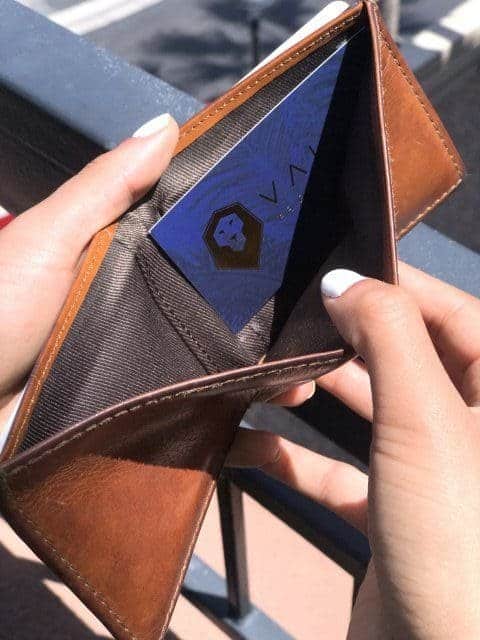

New Asset Qualification Loan | Valor Lending Group

Are you interested in a new asset qualification loan?

Valor Lending Group has got you covered!

What are the benefits of an Asset Qualification Loan?

Borrowers who have been looking to take advantage of an alternative qualifying method such as asset depletion can do so with this asset qualification loan program, with loans up to 80% LTV (loan-to-value) and FICO scores starting at 660. This type of loan qualifies borrowers by using non-traditional methods and/or non-traditional documentation to determine qualifying income. If you are a borrower who wants the chance to qualify using flexible alternatives instead of qualifying with traditional document requirements we have got you covered. With loans up to $4 Million and interest only payments available, let’s find out if this program is going to work for you scenario!

Asset Qualification Loan Program | Highlights:

- Up to 80% LTV for purchase/rate-and-term

- Available for primary residence or second home

- Loan amounts up to $4 Million

- Max cash in hand $2M on cash-out

- Debt-to-income (DTI) up to 50%*

- 6 months Reserves

- Interest-only payments available

- FICO scores as low as 660

Qualification Methods

- Asset Qualifier

- 1099 only

- W2 only

- One-year tax return

- 12-month bank statement

Valor Lending Group offers EVERY mortgage loan in the book!

Recap of our Loan Products:

- Hard Money Loans (20% down / minimal documentation) Typically Fund in 7-10 days.

- Stated Income Loans (Great for business owners and self employed ) No tax returns!

- 100% financing is available (we can cross collateralize other properties if there is enough equity)

- Valor VA Home Loan 100% financing up to $1.5MM

- Investor Cash Flow Loan – No tax returns or DTI calculation! Based on subject property cash flow

- Flipper & Rehab Loans (Flip a property with one of our many options)

- 2nd Position Loans up to $5mm

- Raw Land & Lot Loans

- Ground up Construction for spec homes, custom homes and commercial ground up.

- Farms, Vineyards, Ranches and Agricultural Properties (25-30% down)

- 5% down Jumbo’s with NO MI up to $2mm / 10% down up to $3mm

- Manufactured Housing / Mobile Homes (20% down / 600+ credit score)

- Acreage Properties

- Commercial Loans up to $500mm

- 3% & 5% down Conventional Loans– LPMI (Lender paid mortgage insurance)

- Foreign Nationals Loans (no social security or residency required)

We also offer:

- 10, 15, 20, 25, 30 year Fixed, Conventional Conforming Loans (under $647,200)

- High Balance Conforming aka Super Conforming (from $647,200-$970,800)

- Jumbo’s to $10 Million / Super low rates! / 10% down Jumbo to $3mm

- FHA, USDA

- ARM’s

- Reverse mortgages up to $1 Million Value

- Refinance including Cash Out

**Rates and terms subject to change without notice

We are never too busy for your referrals.

For the most up to date mortgage news visit: Mortgage News Daily

Check out our Google Reviews

Did we miss anything?

- Call or Email me (Stephan Prescher) if there is any information that we have missed

- Follow us on Social Media

- Share this on your Social Media

- Do not hesitate to give us your feedback

- Ask us for a quote

- Visit our homepage to check out what Valor Lending Group has to offer