Useful Tips to Purchasing a Home | Valor Lending Group

Are you ready to purchase a home of your own?

Are you interested in learning some useful tips to purchasing a home?

Purchasing a home can be very stressful, especially if you don’t know where to start. When getting ready to purchase a home there are certain things to consider.

Valor Lending Group is here to help you purchase your new home TODAY!

What are the 4 C’s of a loan?

The 4 C’s stand for Capacity, Capital, Collateral and Credit. This may differ from lender to lender but these are the 4 main components.

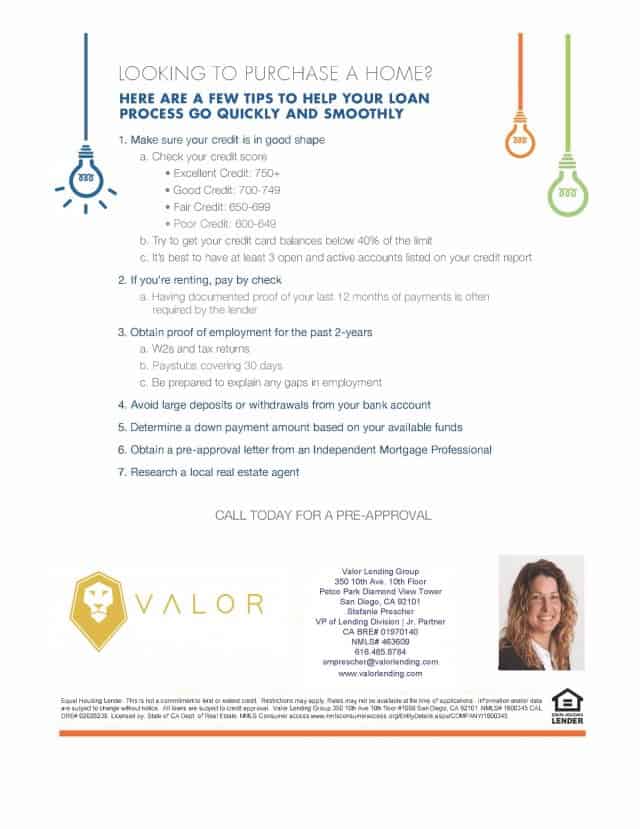

Looking to Purchase a Home?

Here are a few tips to help your loan process go quickly and smoothly.

- Make sure your credit is in good shape

- Check your credit

- Excellent Credit: 750+

- Good Credit: 700-749

- Fair Credit: 650-699

- Poor Credit: 600-649

- Try to get your credit card balances below 40% of the limit

- It’s best to have at least 3 open and active accounts listed on your credit report

- Check your credit

- If you’re renting, pay by check

- Having documented proof of your last 12 months of payments on your credit report

- Obtain proof of employment for the past 2 years

- W2’s and tax returns

- Paystubs covering 30 days

- Be prepared to explain any gaps in employment

- Avoid large deposits or withdrawals from your bank account

- Determine a down payment amount based on your available funds

- Obtain a pre-approval letter from an Independent Mortgage Professional

- Research a local real estate agent

Bottom Line

Valor Lending Group is here to help you with all of your home purchasing needs. Give us a call today to discuss your mortgage loans options.

CALL or EMAIL for immediate attention to your scenario!

Recap of our Loan Products

- Hard Money Loans (20% down / minimal documentation) Typically Fund in 7-10 days.

- Stated Income Loans (Great for business owners and self employed ) No tax returns!

- 100% financing is available (we can cross collateralize other properties if there is enough equity)

- Valor VA Home Loan 100% financing up to $1.5MM

- Rental Property Loan – No tax returns or DTI calculation! Based on subject property cash flow – No DSCR Coverage needed!

- Flipper & Rehab Loans (Flip a property with one of our many options)

- 2nd Position Loans up to $5mm

- Raw Land & Lot Loans

- Ground up Construction for spec homes, custom homes and commercial ground up.

- Farms, Vineyards, Ranches and Agricultural Properties (25-30% down)

- 10% down Jumbo’s up to $1.5mm

- Manufactured Housing / Mobile Homes (20% down / 600+ credit score)

- Acreage Properties

- Commercial Loans up to $500mm

- 3% & 5% down Conventional Loans– LPMI (Lender paid mortgage insurance)

- Foreign Nationals Loans (no social security or residency required)

We Also Offer:

- Conventional Conforming Loans

- High Balance Conforming

- Jumbo Loan Financing | 10% down Jumbo to $1.5mm

- FHA, USDA

- Reverse mortgages up to $1 Million Value

- Cash Out Refinancing

**Rates and terms subject to change without notice

We are never too busy for your referrals!

For the most up to date mortgage news visit: Mortgage News Daily

Check out our GOOGLE REVIEWS

Did we miss anything?

- Call or Email me (Stefanie Prescher) if there is any information that we have missed

- Follow us on Social Media

- Share this on your Social Media

- Do not hesitate to give us your feedback

- Ask us for a quote

- Visit our homepage to check out what Valor Lending Group has to offer